3 Lessons I Learned from Owing the IRS $7k

To keep it 💯, I fell into the LLC Twitter trap yeaaarsss ago!

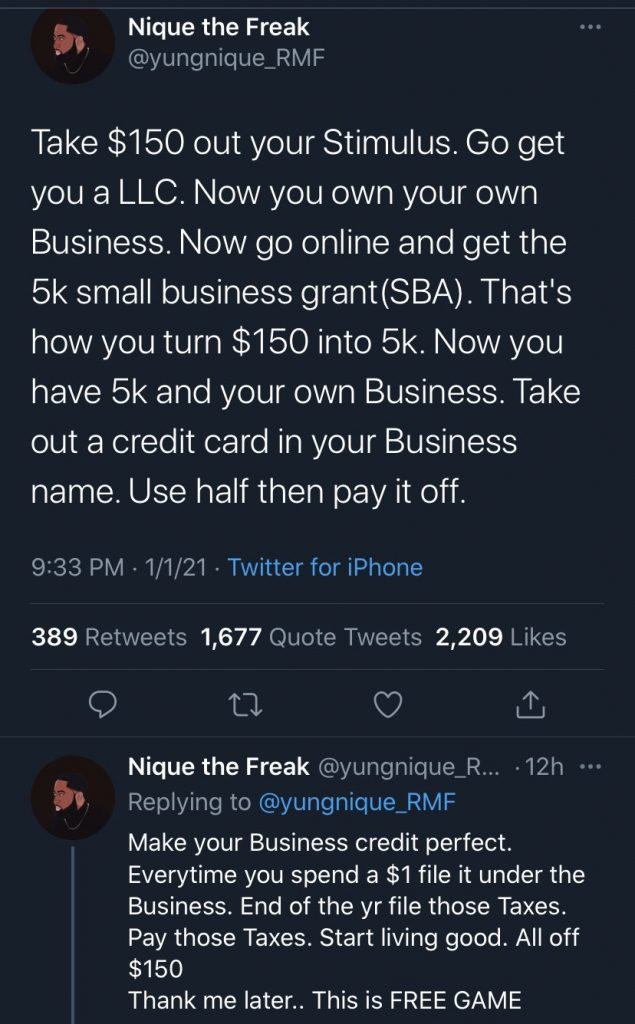

Before I hop into this story, let me tell you what I mean by the LLC Twitter trap. The LLC Twitter Trap is when entrepreneurs/coaches/consultants or influencers hop on a social media platform (it doesn’t necessarily have to be Twitter) post vague, invalid, and sometimes fraudulent information about business, finance, real estate, etc. Most of the time, it’s to invest in the program that they may have available.

And here’s how it happened to me:

I’ve always loved the idea of making money and specifically easy money. In 2016, I decided that I wanted to be more ladylike and started the habit of buying clothes to fit my new style. This meant that I followed a lot of boutiques and similar businesses. There was a young lady in particular who really seemed to be making a living from her store and people would ask all the time; “What are the steps? How do I get started? ” She started to post advice and one of the posts was something along the lines of “start a boutique in 5 steps.” (It’s important to note that people can have, understand, and apply the information but it does not mean that they know how to TEACH what they know) It seemed easy enough so I decided to open up an online Boutique. I had accessories + handbags. I bought the inventory, my wholesale license, a vendors list, had my logo (just like the posts instructed…) I made about three or four posts on Instagram and I really thought I was doing something.

After a few weeks, I decided to shut down. I didn’t sell a pair of shades, you hear me? I had a bunch of inventory, without an audience or money. I was frustrated but I didn’t think anything of it. I said “Welp, I’ll find something else that I actually enjoy. ”

About a year later I received mail about taxes that I owed. I was moving around from state to state so I didn’t get my mail on time. My logic was “I didn’t sell anything so I don’t owe anything.” I didn’t file at anything.

They sent letters for almost 3 years and I never responded mostly because I was afraid.

You see, that’s the toxic relationship that I have with my anxiety. I felt like if I ignore it, It was going to magically go away. Well as you can imagine, it didn’t (because that’s not how any of this works).

Fast forward to 2019 Uncle Sam was after me. The IRS wanted their money. And guess what? I didn’t have it. No one told me about this part. This wasn’t on the meme!

Before I knew it:

I owed the IRS $7k, my accounts were locked (including my joint account with my husband) and I was crying on my momma’s bed. I was already going through a quarter-life crisis! Now I was also feeling devastated, traumatized, and distraught.

All a day before Thanksgiving. I remember it like it was yesterday.

Initially, I didn’t know what happened. I was at the gas station trying to fill my tank grabbing a snack for my offspring when my card declined. I was irritated because I’m saying to the cashier “I know I have money. Run it again”. After the third try, I opened my bank’s app trying to log in and I’m locked out. I thought it was a glitch, but then I quickly realized that it wasn’t. This prompted me to call the bank. The representative told me that “The IRS has locked your account and has a hold on all of your assets with us.” She wanted to help but her hands were tied. “You have to call them to resolve the issue.” As nervous as I was, I knew that I had to call because I needed access to my funds. I had bills to pay. I had a little one to feed & transport.

I ended up calling the hotline and explaining my situation. The representative was very helpful and understanding. She said “ You know if you had called years ago and just told us that you had not sold anything and that you wanted to dissolve your business you wouldn’t have had to go through this. Freezing accounts and assets are one of the last resorts. We have been trying to contact you for about 3 years.” She was right.

After proving that I had not made any money from my business and filling out the paperwork that she had given me, my account was finally unlocked. I still had to pay a recovery fee of about $100 but it sure beats $7000.

Moral of the story:

- Think for yourself + do what you want. Having a boutique was never a dream or goal of mine until I saw someone else doing it. They were walking their path and I tried to walk it with them. 😂 I couldn’t blame anyone because I knew I shouldn’t have started the business. Looking back, my body was rejecting the idea. It never felt good to me. 🥴 (This also prompted me to dig deep and figure out why I wanted that lifestyle so badly that I threw out my common sense.)

- Do your own research. I shouldn’t have hopped in something before doing thorough research. Especially for something that requires a significant starter cost. As I’m reflecting on this time, I don’t think the person who posted the steps were purposely trying to mislead me. They may have thought the in-between steps were common sense or maybe the content I consumed was freebie content meant to get me into a higher ticket program. Either way, it was MY responsibility to know what was going on.

- Keep your books in order + hire a financial professional. Especially if you have a business filed with the state. Bookkeeping is super important. I was charged multiple failure to file fees on top of other fees they attatched. They didn’t care that I didn’t know the laws or what I was supposed to do. The only thing that saved me was I literally didn’t make a penny from the business + I was eligible for the hardship program.

What about you?

What “business advice” should you have ignored? Share in the comments!